First and foremost, investing shouldn’t be complicated. That means finding high-quality businesses with easy-to-understand business models that pay sustainable, market-leading, dividends. Among all the shares in the FTSE 100, Aviva (LSE: AV.) really stands out to me.

7.8% dividend yield

First up is a juicy dividend yield of nearly 8%. This sits comfortably above the present rate of inflation. It may not be among the top payers in the FTSE 100, but what matters more for me is sustainability.

During the pandemic, it shocked the market by cutting its dividend. But putting that aside, payments have been growing consistently during the last decade.

Passive income stocks: our picks

Do you like the idea of dividend income?

The prospect of investing in a company just once, then sitting back and watching as it potentially pays a dividend out over and over?

If you’re excited by the thought of regular passive income payments, as well as the potential for significant growth on your initial investment…

Then we think you’ll want to see this report inside Motley Fool Share Advisor — ‘5 Essential Stocks For Passive Income Seekers’.

What’s more, today we’re giving away one of these stock picks, absolutely free!

In its H1 2023 results, Aviva lifted its interim dividend by 8% to 11.1p. With a full-year payout expected to be around £915m, that translates into a final payment of 22.3p. This will be paid in April 2024.

Wealth – the growth engine

In order for me to rely upon rising dividend payments into the future, I need to have confidence that the business can continue to grow.

Although its Wealth division accounts for a small percentage of overall operating profit, it’s one that I believe offers some of the most exciting opportunities for growth.

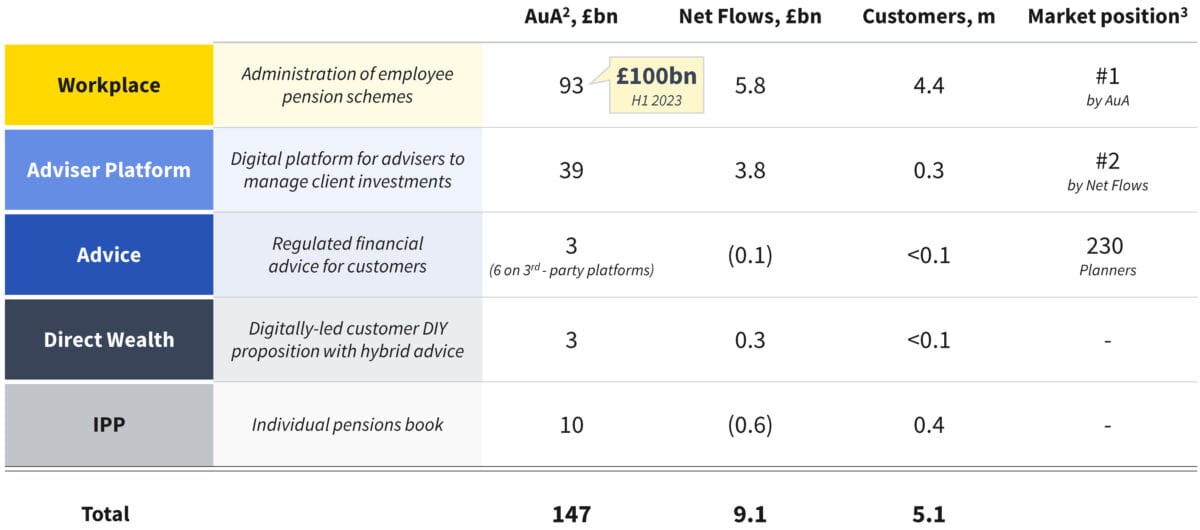

In the next 10 years, this market is expected to nearly triple to £4.3trn. The following infographic shows the breadth of its Wealth business today.

It already possesses market-leading positions in workplace and advisor platform businesses and continues to invest in growth opportunities across advice and direct wealth. This includes the acquisition of Succession Wealth, helping to tap into the growing need for retirement advice.

Its own research report on retirement in the 2050s demonstrates that 73% of people retiring at this point would be interested in support to ensure they don’t run out of money in retirement.

It has a target of growing Wealth to a £250bn assets under management and £280m profits in five years. If it achieves this, I expect its share price to be trading considerably higher in the future.

Risks

Its share price has performed poorly over the past year because, as an asset and investment manager, it’s heavily invested in both corporate and government bonds.

The banking crisis last year exposed the problem of unrealised losses on balance sheets. But, of course, this problem only matters to a company who is forced to sell their bonds before maturity.

At the moment, it has a Solvency II ratio of 202%. That should enable it to weather a normal economic downturn and associated market volatility. However, should yields on bonds go significantly higher, heavy losses could not be ruled out.

Despite these clear risks, Aviva is exposed to a number of tailwinds. The growth of EVs on our roads in the next 10 years is likely to mean the emergence of new insurance business models.

For example, Aviva Zero, a carbon conscious digital-like motor proposition, is one major innovation in this space. It has already sold more than 250,000 policies since its launch less than 18 months ago.

I view Aviva shares as a sleeping giant and will be looking to add more to my portfolio when finances allow.